In an era of growing environmental and social consciousness, individuals are increasingly seeking ways to align their investments with their values. Sustainable finance offers a compelling avenue for achieving this goal, empowering you to generate financial returns while contributing to a more sustainable and equitable world. While this guide provides valuable information and practical guidance for everyday consumers who want to embark on their sustainable investing journey, it is not to be taken as investment advice. So grab your favorite cup of organic, fair-trade coffee or tea, and let’s get started!

Understanding the Fundamentals of Sustainable Finance

Before diving into the world of sustainable investing, it’s essential to grasp the core concepts that underpin this approach. This will allow you to understand the information better and prepare more effective questions for your investment advisor.

- ESG (Environmental, Social, and Governance) Investing: ESG investing considers how companies score on environmental, social, and governance responsibility metrics and standards for potential investments.

- Impact Investing: Impact investing takes a more targeted approach, focusing on investments that generate measurable positive social or environmental impact alongside financial returns. This could involve investing in companies developing renewable energy solutions, affordable housing projects, or initiatives promoting education and healthcare access. For example, the Global Islamic Finance and Impact Investing Platform (GIFIIP) connects Islamic impact investors with enterprises, promoting inclusive financial systems worldwide.

- Green Bonds: Green bonds are fixed-income debt instruments specifically earmarked for projects with environmental benefits. These bonds finance initiatives such as renewable energy installations, energy-efficient buildings, and clean transportation infrastructure.

Exploring ESG in Detail

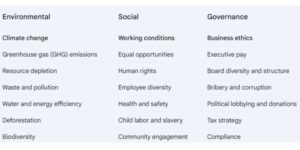

To further clarify what ESG investing entails, here’s a table summarizing the specific topics that fall under each ESG pillar:

Types of Sustainable Investment Funds

Sustainable investment funds pool investors’ money to support companies with strong ESG practices. These funds offer a diversified approach to sustainable investing, allowing individuals to invest in a basket of companies committed to sustainability. Here are the main types of sustainable investment funds:

- Sustainable Equity Funds: These funds invest in stocks of companies with strong ESG performance.

- Sustainable Fixed Income Funds: These funds invest in bonds and other debt securities issued by entities with good ESG practices. Green bonds are a popular instrument within this category.

- Balanced Funds: Sustainable balanced funds combine both equity and fixed income investments to provide a diversified and risk-adjusted portfolio.

- Index Funds and ETFs: These funds track specific ESG-focused indices, offering a passive investment approach.

Benefits of Sustainable Investing

Sustainable investing offers a compelling proposition for investors seeking to make a positive impact while pursuing financial goals.

- Positive Impact: By investing in companies with strong ESG practices, you directly support businesses working towards a more sustainable and equitable future.

- Long-Term Stability: Companies that prioritize sustainability tend to be better prepared for future challenges and have a lower risk of being affected by environmental or social crises, leading to more stable long-term returns.

- Enhanced Returns: Studies suggest that companies with strong ESG practices often outperform their counterparts in the long run.

- Reduced Risk: Focusing on ESG factors can help avoid investments in companies with significant regulatory or reputational risks, potentially mitigating investment losses.

- Enhanced Operational Efficiency: Companies with sustainability strategies often achieve enhanced operational efficiency, increased cost savings, and lower employee turnover.

Challenges of Sustainable Investing

- Performance Concerns: One common misconception is that sustainable investing sacrifices returns. However, evidence suggests that this is not necessarily the case.

- Greenwashing: Some companies may exaggerate their sustainability efforts, making it crucial to conduct thorough research and due diligence.

- Measurement Challenges: Assessing the impact of sustainable investments can be complex, requiring reliable data and standardized metrics.

It’s important to note that sustainable investing is not just about excluding “sin stocks.” Strategies like ESG optimization, where companies with high ESG metrics receive greater portfolio weights, offer a more nuanced approach.

Getting Started: A Step-by-Step Guide

Ready to start your sustainable investing journey? Here’s a step-by-step guide:

- Define Your Values: Identify the social and environmental issues that matter most to you. This will guide your investment choices and ensure your portfolio aligns with your values. For example, if you’re passionate about climate action, you might prioritize investments in renewable energy companies or green bonds.

- Research Investment Options: Explore different sustainable investment options, such as ESG funds, green bonds, and individual stocks of companies with strong ESG practices. Consider your investment goals and risk tolerance when selecting specific options.

- Evaluate Green Investments: When choosing sustainable investment options, it’s crucial to evaluate them thoroughly. Consider factors such as the company’s commitment to sustainability, its track record, and the potential impact of the investment. Also, consider your investment time horizons and align your choices accordingly.

- Assess Impact: Evaluate the potential impact of your investments using ESG scores, sustainability reports, and third-party ratings. However, don’t solely rely on ESG scores; conduct your own research to avoid greenwashing and ensure the company’s practices genuinely align with your values.

- Pre-Investment Estimation and Continuous Monitoring: Before investing, estimate the potential impact of your investment and plan for how to maximize it. Once you’ve invested, continuously monitor the impact to ensure it aligns with your expectations and make adjustments as needed.

- Build a Diversified Portfolio: Diversify your investments across different asset classes, sectors, and geographies to manage risk and enhance returns. For example, combine renewable energy stocks with ESG-focused technology companies and green bond funds.

- Monitor and Adapt: Regularly review your portfolio’s performance and impact, making adjustments as needed to ensure it continues to align with your values and goals.

Inspiring Examples and Case Studies

Here are some examples of successful sustainable investments and initiatives:

- Orsted Group: This Danish energy company transitioned from fossil fuels to become a leader in offshore wind power, demonstrating that clean energy investments can be both profitable and environmentally responsible. Orsted’s investments in wind farms have not only reduced their carbon footprint but also generated substantial returns.

- The Edge in Amsterdam: This green building project showcases how sustainable real estate investments can enhance both financial and environmental performance. The Edge generates more energy than it consumes, thanks to its energy-efficient design, smart technology, and renewable energy sources.

- Shea Value Chain and PACOFIDE projects: These initiatives in Nigeria and Benin promote sustainable production of shea nut and other products, benefiting communities and combating climate change. These projects support agroforestry, increase tree cover and carbon sequestration, and empower women in shea nut processing.

Resources and Tools

To further your sustainable investing journey, explore these helpful resources:

1. Sustainable Investment Platforms:

- Climatize: This platform offers zero fees and a user-friendly app for investing in climate-positive projects.

- Betterment: This robo-advisor provides access to sustainable investment portfolios tailored to your risk tolerance and values.

- Wealthfront: Another robo-advisor with a focus on sustainable investing, offering automated portfolio management and tax optimization.

2. ESG Rating Agencies:

- MSCI: A leading provider of ESG ratings and research, helping investors assess the sustainability performance of companies. https://www.msci.com/

- Sustainalytics: A prominent ESG rating agency, offering comprehensive assessments of companies’ ESG risks and opportunities. https://www.sustainalytics.com/

3. Educational Websites:

- US SIF Foundation: Provides resources and information on sustainable investing trends and strategies.

- Forum for Sustainable and Responsible Investment: Offers insights and guidance on various aspects of sustainable investing.

4. Books and Courses:

- Principles of Sustainable Finance by Dirk Schoenmaker: A comprehensive guide to the principles and practices of sustainable finance.

- University of Cambridge Sustainable Finance Online Short Course: Provides in-depth knowledge on the role of finance in creating a sustainable economy.

Conclusion:

Sustainable finance empowers you to align your investments with your values, generating financial returns while contributing to a more sustainable and equitable world. By understanding the fundamentals, assessing the benefits and challenges, and following the actionable steps outlined in this guide, you can embark on your sustainable investing journey and make a positive impact with your money. More than just a trend, sustainable investing is a powerful tool for driving positive change. Evidence shows that companies prioritizing ESG factors often experience enhanced operational efficiency, reduced risks, and potentially higher returns. By choosing sustainable investment options, you not only support businesses committed to a better future but also potentially enhance your own financial well-being.

Start your sustainable investing journey today and contribute to a world where financial success goes hand in hand with environmental and social responsibility!

PHYSICALLY STRONG … MENTALLY AWAKE … ENVIRONMENTALLY SAFE

What is sustainable finance and how does it differ from traditional investing?

Sustainable finance is an approach to investing that considers environmental, social, and governance (ESG) factors alongside financial returns. Unlike traditional investing, which primarily focuses on profit maximization, sustainable finance aims to generate positive social and environmental impacts in addition to financial gains. It involves aligning investments with one’s values to support a more sustainable and equitable world. Sustainable finance recognizes that companies addressing global challenges are often positioned for long-term growth and financial success.

What do ESG, impact investing, and green bonds mean within the realm of sustainable finance?

ESG (Environmental, Social, and Governance) Investing: This evaluates companies based on their performance in environmental sustainability (climate change, resource depletion, waste), social responsibility (working conditions, human rights, diversity), and corporate governance (business ethics, board diversity, tax strategy). ESG criteria assess how a company manages risks and opportunities in these areas.

Impact Investing: This goes beyond ESG screening and focuses on investments that generate a measurable, positive social or environmental impact, alongside a financial return. Examples include investments in renewable energy, affordable housing, or projects promoting healthcare and education access.

Green Bonds: These are fixed-income debt instruments that are specifically earmarked for projects with clear environmental benefits. They are used to finance initiatives such as renewable energy installations, energy-efficient buildings, and clean transportation infrastructure.

What are some benefits of adopting sustainable investing practices?

Sustainable investing offers several benefits:

Positive Impact: Directly supports companies working towards a more sustainable and equitable future.

Long-Term Stability: Companies prioritizing sustainability are often better prepared for future challenges, leading to more stable returns.

Enhanced Returns: Studies suggest that companies with strong ESG practices often outperform their counterparts over the long term.

Reduced Risk: Helps to avoid investments in companies with significant regulatory or reputational risks.

Enhanced Operational Efficiency: Companies with sustainability strategies may benefit from lower costs and increased employee retention.

What are the potential challenges or concerns associated with sustainable investing?

While sustainable investing is beneficial, some challenges exist:

Performance Concerns: A misconception is that sustainable investing sacrifices returns; however, evidence suggests that this isn’t the case.

Greenwashing: Some companies may exaggerate their sustainability efforts. Therefore, thorough research and due diligence are essential.

Measurement Challenges: Assessing the actual impact of sustainable investments can be complex, requiring reliable data and metrics, although standardization is improving.

What steps can a beginner take to start investing sustainably?

Here are actionable steps for beginners:

Define Your Values: Identify the social and environmental issues that are most important to you to guide your investment choices.

Research Investment Options: Explore options like ESG funds, green bonds, and stocks of companies with strong ESG practices.

Evaluate Green Investments: Thoroughly evaluate investment options based on the company’s commitment, track record, and potential impact.

Assess Impact: Evaluate the potential impact of investments using ESG scores, reports, and third-party ratings, while also conducting independent research to avoid greenwashing.

Pre-Investment Estimation and Continuous Monitoring: Estimate the potential impact of investments before investing, monitor it afterwards, and adjust when necessary.

Build a Diversified Portfolio: Diversify investments across different asset classes, sectors, and geographies to manage risk and enhance returns.

Monitor and Adapt: Regularly review your portfolio’s performance and impact, and make adjustments to ensure alignment with your values and goals.

What are some specific examples of successful sustainable investment initiatives?

Examples include:

Orsted Group: Transitioned from fossil fuels to become a leader in offshore wind power, demonstrating that renewable energy investments can be profitable.

The Edge in Amsterdam: A green building project showcasing how sustainable real estate investments can enhance both financial and environmental performance.

Shea Value Chain and PACOFIDE Projects: Initiatives in Nigeria and Benin that promote sustainable production, benefitting communities and combating climate change.

What resources are available for individuals looking to learn more about sustainable finance and investing?

Helpful resources include:

Sustainable Investment Platforms: Climatize, Betterment, and Wealthfront offer access to sustainable investment portfolios.

ESG Rating Agencies: MSCI and Sustainalytics provide ESG ratings and research.

Educational Websites: The US SIF Foundation and Forum for Sustainable and Responsible Investment offer resources and information.

Books and Courses: “Principles of Sustainable Finance” by Dirk Schoenmaker and courses from the University of Cambridge are valuable resources.

Is sustainable investing just a trend, or does it represent a significant shift in the world of finance?

Sustainable investing is more than a trend; it represents a fundamental shift towards integrating financial and non-financial considerations. It’s increasingly viewed as a powerful tool for driving positive change, where financial success goes hand in hand with environmental and social responsibility. Evidence suggests companies that prioritize ESG factors often experience enhanced operational efficiency, reduced risk, and potentially higher returns, signaling that sustainable investing is becoming an essential component of the future of finance.